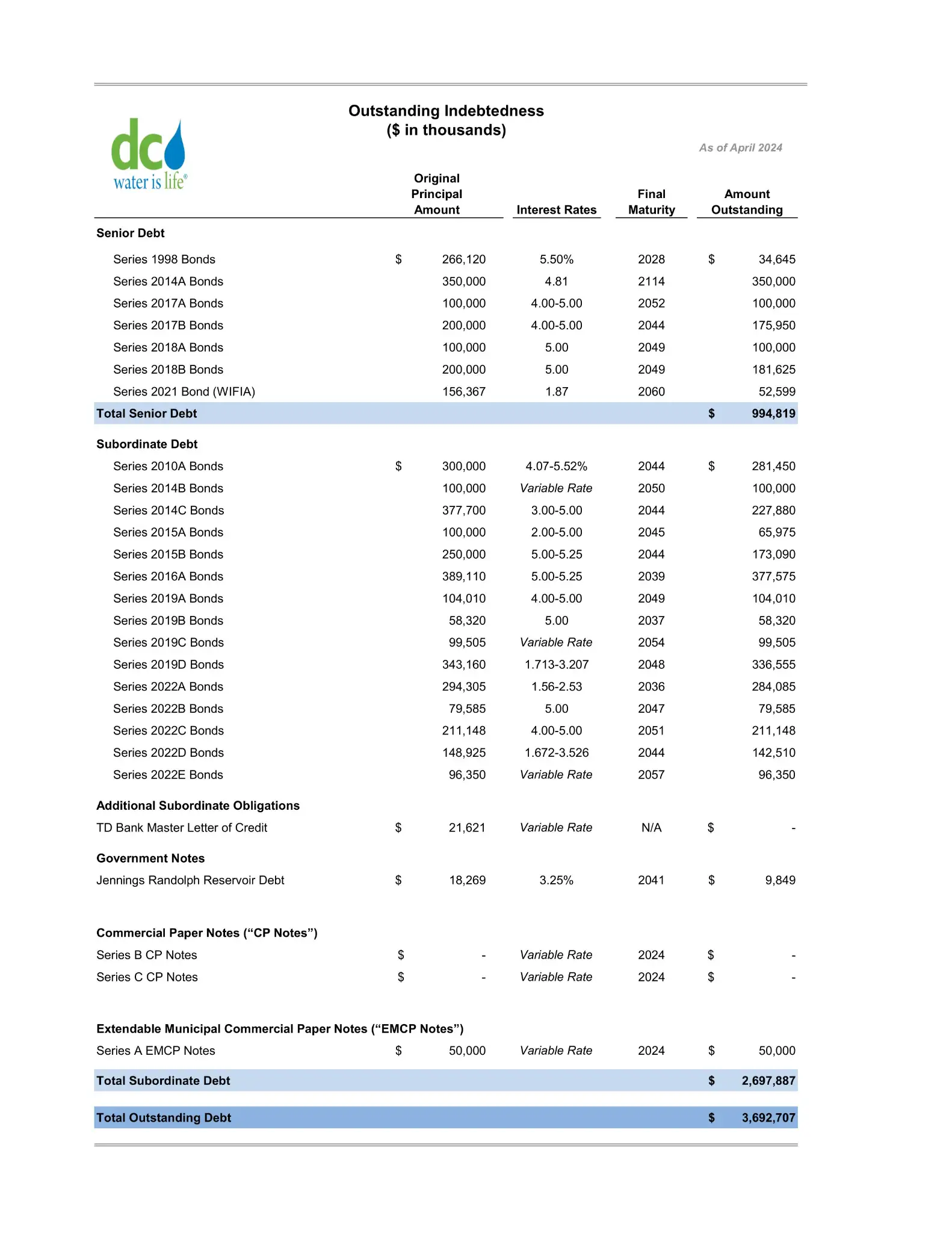

Commercial Paper and Extendable Municipal Commercial Paper (EMCP)

Commercial Paper - CP

Taxable and Tax-Exempt Series D CP Notes - Not to exceed $250,000,000

Amount Currently Outstanding (total): $0 (as of October 2024)

Description/Purpose: These notes issued are considered subordinate debt under the Master Indenture of Trust. DC Water’s commercial paper is issued in increments with maturities less than 270 days. The Board approved the commercial paper program in early FY 2002; a revised Board approval in June 2024 increased the CP program by $100,000,000. Proceeds from the sale of the notes are used for interim bond financing, short-term financing for capital equipment and certain taxable costs for the Washington Aqueduct. Each new bond issuance is evaluated to determine the most cost-effective way of reducing the amount of taxable commercial paper. Normal market conditions for commercial paper carry significantly lower interest rates than long-term debt. The series B notes have been issued under the commercial paper program: the interchangeable taxable and tax-exempt Series D CP Notes in an aggregate principal amount not to exceed $250,000,000.

Dealer: JP Morgan Chase Bank and Goldman Sachs & Co, LLC

Issuing Paying Agent: US Bank

Extendable Municipal Commercial Paper – EMCP

Series A Notes - Not to exceed $100,000,000

Amount Currently Outstanding: $50,000,000 (as of October 2024)

Description/Purpose: The Authority has also authorized a $100 million Extendable Municipal Commercial Paper (EMCP) Program. The program consists of one series - A, in the amount of $100 million. This program will provide interim financing for a portion of the Authority’s Capital Improvement Program. Under this program the notes are issued backed by the liquidity and credit rating of the Authority. Each Series A EMCP Note will mature on its respective “Original Maturity Date”, which may range from one to 90 days from the date of issuance, unless its maturity is extended on the “Original Maturity Date” to the “Extended Maturity Date”, which will be the date that is 270 days after the date of issuance of the Series A EMCP Note. The notes are payable from and secured by a subordinate lien on the Authority’s net revenues, as further described in the Authority’s master trust indenture as supplemented.

Dealer: Goldman Sachs & Co, LLC

Commercial Paper and Extendable Municipal Commercial Paper